For general inquiries or questions please contact us at info@pbafglobal.com.

Roel Nozeman is Chair of PBAF and Senior Advisor Biodiversity at ASN Bank. He is responsible for the biodiversity pillar of ASN Bank and the Volksbank group. With a diverse background in both the financial and the environmental sector he strives to bring these different worlds together and contribute to a sustainable future.

Wijnand Broer is Program Manager at PBAF and partner at CREM, a Netherlands based consultancy in the field of sustainable development. Wijnand has specialised in the areas of Corporate social responsibility, Business & Biodiversity, Natural Capital and Socially Responsible Investment.

Bas Smeets is an Impact Analyst for Biodiversity and Climate at ASN Bank. He is co-responsible for the climate reporting of ASN Bank and the Volksbank, and works as a program assistant for PBAF. He has a diverse background in biology, sustainable business and finance.

Biodiversity is more than just the variety of species. The Convention on Biological Diversity (CBD) defines biodiversity as follows:

Biological diversity means the variability among living organisms from all sources including, among others, terrestrial, marine and other aquatic ecosystems and the ecological complexes of which they are part; this includes diversity within species, between species and of ecosystems.

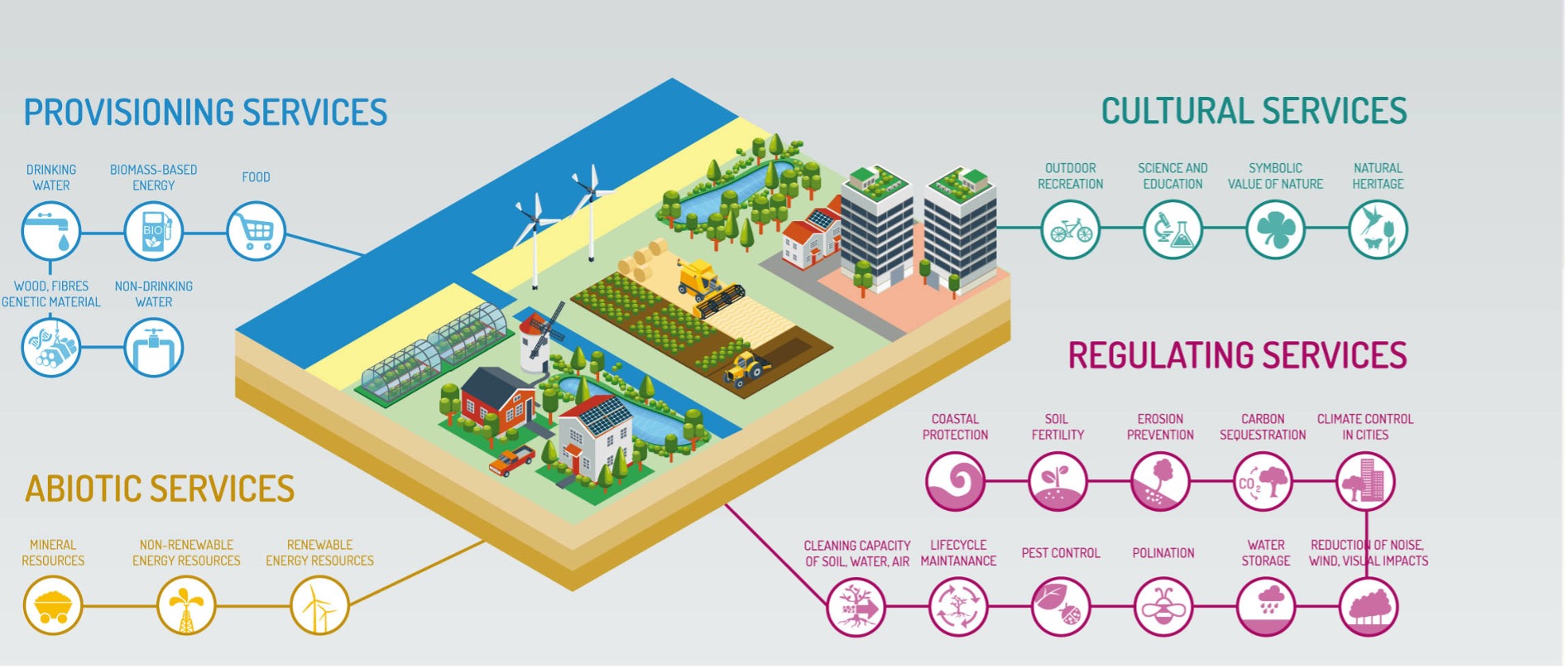

Biodiversity underpins the services that nature provides, like carbon sequestration, water purification, pollination and the provision of food and fibres. All economic activities depend on the provision of ecosystem services and biodiversity plays a key role in climate change mitigation and adaptation. The provision of these services has always been taken for granted but is increasingly at risk due to the loss of biodiversity.

The ability of an ecosystem to deliver the services we depend on reduces when the system is less biodiverse. This is affecting companies and can lead to (1) physical, (2) reputational and (3) transitional risks for investors. An example of a physical risk is the reduction of crop yield due to a reduction of pollinators affecting crop pollination. Reputational risks can arise from the loss of biodiversity underpinning services used by local stakeholders, like clean water. Transitional risk can arise when consumer preferences change and legislation is put in place to halt the loss of biodiversity, like an increase in protected areas, affecting economic activities. By addressing the loss of biodiversity now, risks can be managed and investment opportunities can be identified.

Adapted from PBL, 2014

Most human activities impact biodiversity, either positively (e.g. reforestation activities) or negatively (most economic activities, like agricultural and mining). A biodiversity impact assessment provides insight into the likelihood that a loan or investment, through the economic activities invested in, will have a negative or positive impact on biodiversity in and the reasons why.

A biodiversity impact assessment can take different forms, serve different objectives and can be used at different stages in an investment process. Examples range from a deforestation risk screening of possible loans and investments, an analysis of impact risks based on the IFC Performance Standard 6, to a detailed and quantified biodiversity footprint of an entire investment portfolio.

In a ‘biodiversity footprint’, the impact on biodiversity is measured and expressed in a metric, like the loss of species. This footprint can be based on monitoring of actual changes in biodiversity through time (assessment of actual impact), or can be based on an assessment of the expected or ‘potential impact’. This potential impact is often based on the contribution of an economic activity to drivers of biodiversity loss or biodiversity gain, like land use, pollution or climate change.

Different types of impact assessment require different tools, different data and different investments in time and know-how. Financial institutions new to the topic of biodiversity can start with small steps

Most human activities impact biodiversity, either positively (e.g. reforestation activities) or negatively (most economic activities, like agricultural and mining). A biodiversity impact assessment provides insight into the likelihood that a loan or investment, through the economic activities invested in, will have a negative or positive impact on biodiversity in and the reasons why.

A biodiversity impact assessment can take different forms, serve different objectives and can be used at different stages in an investment process. Examples range from a deforestation risk screening of possible loans and investments, an analysis of impact risks based on the IFC Performance Standard 6, to a detailed and quantified biodiversity footprint of an entire investment portfolio.

In a ‘biodiversity footprint’, the impact on biodiversity is measured and expressed in a metric, like the loss of species. This footprint can be based on monitoring of actual changes in biodiversity through time (assessment of actual impact), or can be based on an assessment of the expected or ‘potential impact’. This potential impact is often based on the contribution of an economic activity to drivers of biodiversity loss or biodiversity gain, like land use, pollution or climate change.

Different types of impact assessment require different tools, different data and different investments in time and know-how. Financial institutions new to the topic of biodiversity can start with small steps

It is important to realise that a biodiversity impact assessment is only one step in managing the topic of biodiversity as a financial institution. Other important steps include the development of a (sector specific) biodiversity policy, the use of biodiversity related investment/loan criteria, engagement with investees and the development of a long term biodiversity goal (e.g. reaching a ‘no net loss’ or ‘net gain’ on a portfolio level). The results of an impact assessment can be used to inform these other steps. For example, insight in the drivers of biodiversity loss in different sectors can be used to develop or refine sector specific investment criteria and can be used to ask the right questions in company engagement.

A biodiversity footprint is in many ways similar to carbon footprint. Both footprints are calculated in a similar manner, using life cycle assessment (LCA) based footprint methodologies. While a carbon footprint is focusing on the emissions of greenhouse gasses, a biodiversity footprint is based on the impact of a number of environmental pressures, including climate change, but also pressures like land use, pollution and water use. Financial institutions that have already conducted a carbon footprint can use this data in the assessment of the impact on biodiversity. Of course, data on the other pressures will need to be added.

Note that climate change and biodiversity loss are closely interrelated. Climate change has an impact on biodiversity loss since rising temperatures can disrupt ecosystems. At the same time, degrading ecosystems release greenhouse gas emissions affecting climate change. However, biodiversity can also be a key asset for climate change mitigation and climate change adaptation. Carbon sequestration in carbon-rich ecosystems, like forests, grasslands, drylands, coastal and/or marine ecosystems (e.g. mangroves) and other wetlands (e.g. peatlands) contributes to climate mitigation. Nature-base Solutions like agroforestry and restoration of coastal ecosystems (like mangroves) contribute to climate adaptation.

A biodiversity footprint will show to what extent changes induced by a climate policy affects biodiversity (e.g. the first generation of biofuels resulted in increased land use, affecting biodiversity) and the other way around (e.g. reforestation will lead to carbon sequestration, benefiting the carbon footprint). The synergies of addressing climate and biodiversity simultaneously results in opportunities for the financial sector, both from an investment opportunity perspective (like investments in nature based solutions) and from a risk mitigation perspective: addressing two key risks to the sector in a synergetic way.

There is a wide variety of tools available to assess the biodiversity impact (risk) of loans and investments and a growing number of data providers and consultancies that offer services in this field. So many, that it may be hard to see the trees through the forest. Some of the tools offer data on the biodiversity characteristics of areas, others offer an LCA-based approach to calculate a quantified biodiversity footprint. These tools can be used at different stages in the investment process and serve different objectives. It is therefore important to have a clear idea of what question you want to answer.

Do you want to know:

These questions can be answered with different methodologies, some more complex and time consuming than others. Further guidance can be found in this PBAF Standard and overviews of tools and their focus can be found in publications by the EU Business@Biodiversity Platform and the Finance for Biodiversity Pledge, like the Finance for Biodiversity Guide on biodiversity measurement approaches.

The data need in an impact assessment depends on the question that needs to be answered (“What is the deforestation risk of this loan?” versus “What is the quantified footprint of my portfolio?”) and the way the question is answered (monitoring of actual impact or a calculation of potential impact?). In general, the steps between a loan or investment and biodiversity are the following:

Investment (1)--> Economic activities (2)--> Environmental inputs and outputs (3)--> Drivers of biodiversity loss (4)+ Location (5)= Impact

The data need often focuses on the steps 1, 2 and 4:

Please note that an impact assessment can also include the supply chains of the company invested in. When data on supply chains are missing (which is often the case), supply chains can be modelled using databases.

Depending on the impact assessment one or more of these steps may be irrelevant and the need for data will be reduced. For example, answering the question if an investee is located in or close to a protected area only requires data on step 4, location.

An important question when calculating the biodiversity footprint of a loan or investment is to what extent the financial institution takes responsibility for the impacts in the investees’ value chain(s). Financial institutions may decide differently on this point, so transparency is key.

From the perspective of carbon footprinting, the inclusion of scopes 1 (impacts of the company itself) and 2 (impacts of the energy companies the company sources its energy from) is a generally accepted approach. The inclusion of the full scope 3 (upstream, towards suppliers and sub-suppliers, and downstream, towards the use and end-of-life phase), however, is not.

In biodiversity footprinting, scope 3 upstream should be included since the impact on biodiversity is typically highest in the supply chain: raw material production and processing, like agriculture and mining, mainly due to land use intensity and land use changes. Including scope 3 upstream will therefore provide important insights in how the impact on biodiversity might be influenced through investment criteria and engagement. Scope 3 downstream is ideally also included since biodiversity impacts can also play an important role in the use and end-of-life phase of products and services. However, inclusion of downstream impacts may pose a challenge due to the fact that (for example) products can be used in many different ways.

To have a complete picture of your impact on biodiversity, an impact assessment ideally includes all loans and investments in a portfolio. However, in practice a step by step approach may be more realistic. For example, by starting-off with priority sectors which are known for their high impact on biodiversity (overviews of such sectors are available) or with investees located in or close to protected areas or Key Biodiversity Areas. Moreover, you may decide to start with one or more pilot projects (one or more loans/investments or projects) to get familiar with impact assessment and explore what approaches are best tailored to your needs.

The results of an impact assessment will depend on the assessment conducted. An assessment of deforestation risks can result in an overview of risk scores for different loans or investments, while a biodiversity footprint for a project may result in a graph which shows what impact is caused by what driver of biodiversity loss. The footprint of an investment portfolio can be shown as a total impact score for a portfolio, but also as an impact score per company or sector or per euro invested.

Depending on the way the result is presented, it will allow a financial institution to compare sectors, companies and investments. Note that the real value of an impact assessment is often in the information behind the score: what drivers of biodiversity loss or gain are responsible for the score and what does this mean for a sector’s or company’s action perspective?

A biodiversity impact assessment which shows what (potential) impact a sector, company or project has on biodiversity (positive or negative) and why, can be used to:

By doing so, financial institutions can:

This depends on the impact assessment. A simple risk screening, like an assessment of the biodiversity characteristics of the area where investees are located, can relatively easily be conducted by E&S officers using databases like IBAT. More complex footprint calculations will often be conducted by data providers and consultants. In the latter case it is key to understand how such footprints are calculated and what the value and limitations are.

There is no simple answer to the question what time is needed to conduct a biodiversity impact assessment. This will (again) depend on the question that needs to be answered and on the availability of data needed for the assessment. Conducting a screening for a project investment looking at local biodiversity characteristics can be done in minutes, while data gathering for a quantified portfolio footprint or project footprint may take a few days, depending on the availability of data (and provided the actual footprint calculation is outsourced).

The trend in the market is that a growing number of databases and dashboards is being developed (either or not behind a paywall) with readily available data on location specific biodiversity characteristics and sector or company specific impact data. This will rapidly reduce the time input required for conducting an impact assessment. Again, it will be key to understand the assumptions behind the calculations and related limitations to the data provided.

An easy start to biodiversity impact assessment is to map the exposure of your investment portfolio to high risk sectors, both from an impact and a dependency point of view. For example, by using the sectors identified in the UNEP-FI publication ‘Beyond business as usual: biodiversity targets and finance’. This will provide first insight in biodiversity related risks.

A second step could be to join one or more of the initiatives on biodiversity in the financial sector, like PBAF. This will allow you to discuss the topic, different approaches and case studies with colleagues from other financial institutions.

A third step could be to conduct one or two pilot studies, calculating the footprint of one or two loans of investments in order to gain a better understanding of the methodologies used, the results and the way these results can be used. Focus could be loans or investments in one or more high priority sectors.